Transfer Values, Cash Lump Sums, And Early / Late Retirement Pensions: The Impact Of Changing Interest Rates – An Update

Your pension in the Defined Benefit (DB) Section

The benefits you’ve built up in the DB Section depend on your Pensionable Service (the service you’ve completed with the Company as an Active member of the DB Section) and your Final Pensionable Earnings. After you leave service, your pension will increase each year, in line with the Scheme Rules until your Normal Retirement Date.

Your pension will then be payable to you for life and is a guaranteed income that doesn’t depend on the investment performance of the Scheme or financial market conditions.

However, there are other options available to you as a member of the DB Section. These include:

- Transferring the value of the benefits you’ve built up in the DB Section to another HM Revenue and Customs (HMRC) approved pension arrangement;

- Exchanging (‘commuting’) part of your pension for a one-off tax-free cash lump sum (referred to as a ‘pension commencement lump sum’, subject to HMRC limits); or

- Requesting to retire earlier or later than your Normal Retirement Date.

Each of these options involve placing a value on the benefits you’ve built up in the DB Section at the time you take that option, meaning financial market conditions would be relevant.

Calculating the value of the benefits you’ve built up in the DB Section

To make this calculation the Trustee must estimate how much money it would need to set aside to:

- Pay your pension from the DB Section for the rest of your life; plus

- Pay to your Spouse, Civil Partner or other relevant surviving Dependant(s) any benefits payable to them.

To do this, the Trustee makes several assumptions about the future; including what investment returns the Scheme could expect on the assets it holds. The higher the expected returns are, the less money the Trustee would need to set aside now to pay the benefits you’ve built up. This value is often referred to as your Cash Equivalent Transfer Value (CETV).

The Scheme’s transfer value assumptions are set by the Trustee, based on the regulatory requirements and advice from the Scheme Actuary. They are intended to be a best estimate of what the Trustee would need to set aside to pay the benefits a member has built up in the DB Section. The Trustee’s current policy is to update these assumptions monthly to take into account any changes in market conditions.

The impact of changing interest rates on CETVs

To provide a good match to future pension payments the Scheme invests extensively in bonds (and similar assets). When there is a rise in the yields (or long-term interest rates) available for these types of investments, the Trustee makes the assumption that the expected future investment returns on these assets also increase. Similarly, when there is a fall in long-term interest rates, the Trustee makes the assumption that the expected future investment returns on the Scheme’s assets also falls.

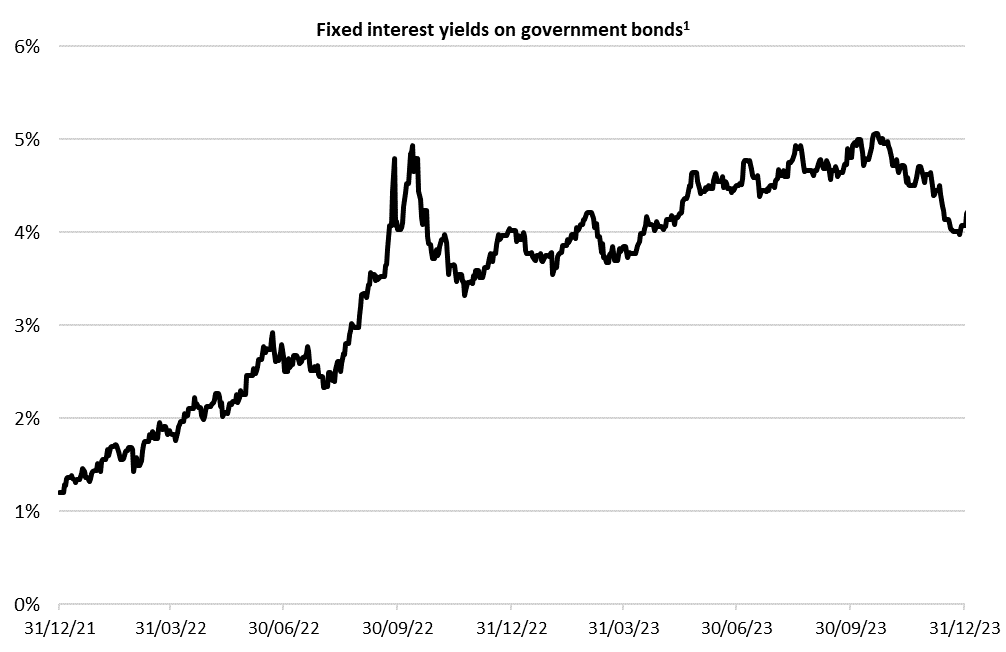

Prior to 2022, we went through a period of historically low interest rates, and CETVs over the period were therefore high relative to historical levels. However, as illustrated in the chart below, during 2022 longer-term interest rates increased substantially. The chart also shows that during 2023 long-term interest rates remained significantly higher than over the previous decade and that there were also some relatively large upwards and downwards changes over the course of the year.

The general increase in long-term interest rates over 2022 and 2023 relative to the previous decade means that the Trustee is now expecting to achieve higher returns on the assets that it holds. As a result, CETVs have fallen, in some cases, by as much as 50% when compared to the period before 2022.

It should be noted that long-term interest rates will continue to fluctuate over time. All else being equal, if there were higher interest rates in the future, then this would cause a reduction in CETVs, whilst lower interest rates in the future could lead to an increase in CETVs. But it is important to remember that the benefits you’ve built up in the DB Section remain the same, it’s simply that the estimated cost to provide these benefits can change over time.

The impact of interest rates on exchanging pension for a cash lump sum

Similar to calculating a CETV, to calculate how much cash you may receive for each £1 of pension you commute, the Trustee estimates how much it would cost to provide that £1 of pension each year for the remainder of your life. However, unlike the calculation of CETVs the calculation does not consider any pension payable after your death (as these will remain at the same level as had you not commuted any of your pension for a cash lump sum).

Therefore, just like transfer values, as long-term interest rates rose over 2022 and 2023, the lump sum payable in exchange for each £1 of your annual pension income given up fell. Similarly to transfer values, it should be noted that a lump sum payable at retirement could be lower than an illustrative estimate previously provided if there are increases in long-term interest rates after the illustration is provided.

The impact of interest rates on taking your pension earlier or later than your Normal Retirement Date

If you request to take your pension at a date other than your Normal Retirement Date the Trustee needs to ensure that the value of your benefits remains broadly the same. As a result, early and late retirement pensions may also be affected by changes to long-term interest rates, albeit the impact will be less than is the case for transfer values or the cash lump sum. For example, whilst the cost to provide your pension at your Normal Retirement Date may have reduced, the cost to provide the relevant reduced pension at an earlier date will also have reduced (although not by exactly the same amount). As a general rule, all else being equal, when interest rates rise a bigger reduction is applied to pensions on early retirement.

More information

If you have any questions regarding your DB Section benefits, please contact the DB Section Administrator.

Note on Additional Voluntary Contributions (AVCs) and Transfers-in: the information above relates to defined benefit pensions in the DB Section. The benefits payable in respect of AVCs invested using the Commercial AVC arrangements or money purchase transfers-in do depend on performance in the investment markets.

The Trustee

January 2024